Protecting Your Haven: The Ultimate Guide to Home Insurance

Joe Howard -

Whether you’re a new homeowner or have been living in your beloved haven for years, it’s essential to protect your investment with the right insurance coverage. Home insurance offers peace of mind, shielding you from unexpected financial burdens that can arise from damage to your property or belongings. In this ultimate guide to home insurance, we will delve into the ins and outs of this vital protection, along with exploring related policies such as contractor insurance, general liability insurance, bonds insurance, and workers’ comp insurance. By understanding the nuances of these coverage options, you’ll be better equipped to safeguard your home and everything within it. So, let’s dive in and discover the key aspects of home insurance and its various extensions.

1. Understanding Home Insurance

Home insurance is a crucial component in safeguarding your haven. It provides financial protection against potential risks and unexpected events that may cause damage or loss to your dwelling. Understanding the intricacies of home insurance is essential in ensuring you choose the right coverage for your needs.

Contractor insurance is an integral part of home insurance. When you hire contractors to work on your property, contractor insurance protects you from liability in case of accidents or property damage during construction or renovation projects.

General liability insurance is another component of home insurance that shields homeowners from liability claims. It covers bodily injury or property damage caused by accidents on your premises, ensuring you won’t bear the financial burden alone.

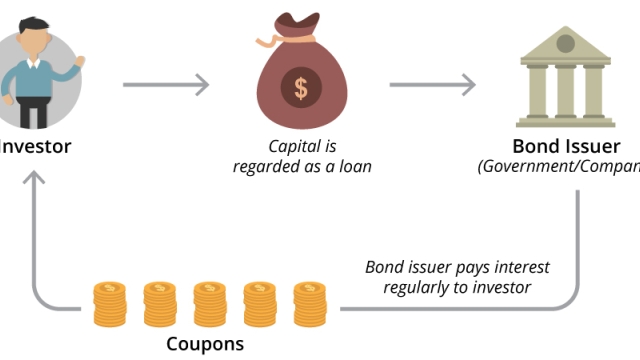

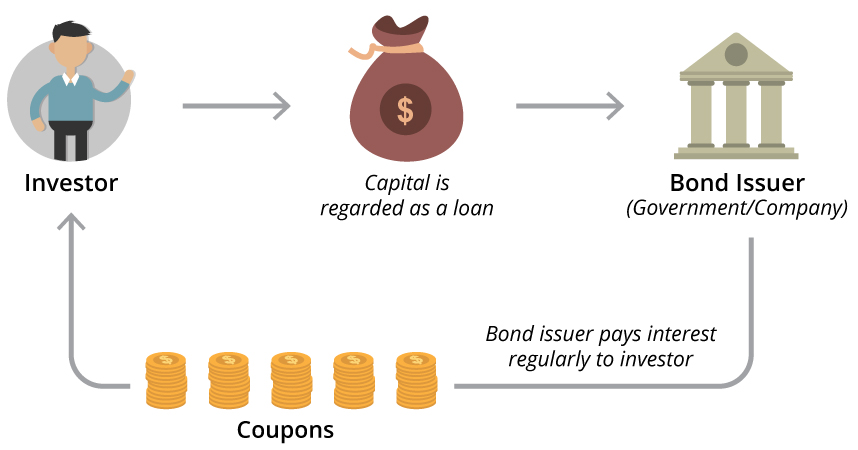

Bonds insurance also falls under the umbrella of home insurance, offering a safety net for homeowners. These bonds provide compensation if contractors fail to complete the agreed-upon work or breach the contract, ensuring you are not left dealing with unfinished projects or financial loss.

Lastly, workers comp insurance is a vital coverage within home insurance. It safeguards homeowners from potential liability claims if a worker gets injured while working on your property. This insurance covers medical expenses and lost wages, providing peace of mind and financial protection.

Understanding the various aspects of home insurance, such as contractor insurance, general liability insurance, bonds insurance, and workers comp insurance, is crucial for homeowners. By having the right coverage in place, you can feel secure in protecting your haven from unexpected events and potential risks.

2. Essential Insurance Coverage for Contractors

Contractors play a vital role in the construction industry, taking on various projects to transform your vision into reality. However, it is crucial for contractors to protect themselves and their clients by securing the right insurance coverage. Here are three essential types of insurance that every contractor should consider:

-

Home Insurance: As a contractor, having home insurance is paramount to safeguard your clients’ homes during construction or renovation projects. This type of insurance provides coverage for property damage caused by accidents, fires, or natural disasters. With home insurance in place, both contractors and homeowners can have peace of mind knowing that any unexpected incidents are adequately covered.

General Liability Insurance: Operating a contracting business involves certain risks and potential liabilities. General liability insurance offers protection against claims made by third parties for bodily injury or property damage caused by the contractor’s work. It covers expenses such as legal fees, medical bills, and property repairs, ensuring that contractors are financially protected in case of accidents or mishaps.

-

Workers’ Compensation Insurance: When working on construction sites or handling manual labor, accidents can happen. Workers’ compensation insurance is essential for contractors as it provides coverage for work-related injuries or illnesses sustained by employees. This type of insurance assists in covering medical expenses, lost wages, and rehabilitation costs, helping contractors fulfill their obligations towards their workers’ well-being.

By investing in these essential insurance coverages, contractors can mitigate potential risks and protect their businesses, their clients, and their workers. Having comprehensive insurance gives contractors the confidence to carry out their work effectively while ensuring that homeowners are covered in case of unforeseen events.

3. Ensuring Comprehensive Protection with Liability, Bonds, and Workers Comp Insurance

When it comes to protecting your haven, simply having home insurance may not always be enough. Ensuring comprehensive coverage means considering additional types of insurance such as liability, bonds, and workers comp insurance.

Liability insurance is crucial in safeguarding your financial well-being when accidents happen on your property. It provides protection in case someone gets injured or their property gets damaged while visiting your home. With liability insurance, you can have peace of mind knowing that you won’t be held personally responsible for unexpected mishaps.

Bonds insurance, on the other hand, plays a vital role if you’re planning any home improvement projects or renovations. Hiring contractors to work on your property comes with certain risks. Bonds insurance protects you from potential financial loss if the contractor fails to complete the job or causes damage to your property. It ensures that you won’t be left in the lurch if something goes wrong during the construction process.

Lastly, workers comp insurance is essential if you have individuals working in or around your home. Whether you have household employees like caretakers or gardeners, or if you hire contractors for specific tasks, workers comp insurance provides coverage in case they get injured while working. It not only protects the workers, but also shields you from potential legal liabilities and the associated costs.

By considering liability, bonds, and workers comp insurance alongside your home insurance, you can create a solid safety net for your haven. These additional layers of protection ensure that you are well-prepared for unexpected events and can enjoy your home with greater peace of mind.

Archives

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | 31 | |