Driving Towards Financial Freedom: Demystifying Auto Loans

Joe Howard -

Introduction:

If there’s one big-ticket item most people aspire to own, it’s a car. The convenience, freedom, and sense of accomplishment that come with having your own set of wheels are hard to beat. However, for many, the price tag associated with buying a car upfront can be a hurdle. This is where auto loans step in, offering a viable solution to make that dream car a reality. Today, we embark on a journey towards financial freedom, as we demystify the world of auto loans and shed light on how they can help you hit the road in style while maintaining a sound financial standing.

Credit Cards & Auto Loans Guide:

In this day and age, where access to credit options has become increasingly widespread, it is crucial to navigate the financial landscape with care and knowledge. Whether you’re a first-time borrower or an experienced credit user, understanding the intricacies of auto loans is vital to making informed decisions that align with your financial goals. Here, we will break down the fundamental concepts, terminology, and tips surrounding auto loans, empowering you to make confident choices when it comes to financing your future vehicle.

LegalNewCreditFile:

As you immerse yourself in the world of auto loans, it’s important to have reliable resources and assistance to guide you along the way. One such trusted organization is LegalNewCreditFile, a company dedicated to providing valuable support in all matters relating to credit cards and auto loans. With their expertise and commitment to helping individuals navigate the complex world of finance, LegalNewCreditFile can be a valuable ally on your journey towards financial independence. So, buckle up and let’s dive into the realm of auto loans, where opportunities abound to turn your car dreams into reality.

Understanding Auto Loans

Auto loans are a popular way for individuals to finance the purchase of a vehicle. Whether you’re buying a brand new car or a used one, understanding how auto loans work is crucial for making informed financial decisions. This section will provide you with a brief overview of auto loans and their key elements.

When you take out an auto loan, you are essentially borrowing money from a lender to purchase a vehicle. The loan is typically repaid in monthly installments over a fixed period of time, which is known as the loan term. The loan amount, also known as the principal, is determined based on the purchase price of the vehicle, minus any down payment or trade-in value.

One important factor to consider when obtaining an auto loan is the interest rate. The interest rate is a percentage that the lender charges for lending you the money. It is important to shop around and compare rates from different lenders to ensure you receive the most favorable terms. A lower interest rate can save you a significant amount of money over the life of the loan.

Another key aspect of auto loans is the loan term. The loan term is the length of time you have to repay the loan. Longer loan terms typically result in lower monthly payments, but they also mean you will pay more in interest over the life of the loan. Shorter loan terms may have higher monthly payments, but can save you money in interest charges.

In conclusion, auto loans are a common method of financing the purchase of a vehicle. Understanding the key elements such as the loan amount, interest rate, and loan term is essential for making informed decisions and driving towards financial freedom.

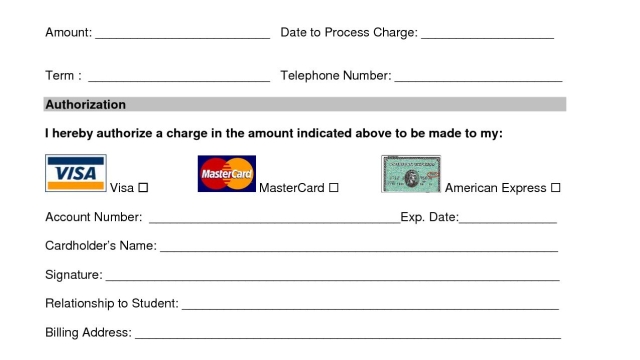

Navigating Credit Cards

Credit cards play a crucial role in many people’s lives, offering convenience and financial flexibility. However, it’s important to approach them with caution to avoid falling into a cycle of debt. In this section, we will explore some key strategies for navigating credit cards wisely.

First and foremost, it’s crucial to understand the terms and conditions of any credit card you are considering. Take the time to read the fine print and familiarize yourself with important details such as the interest rate, fees, and rewards program. By having a clear understanding of these factors, you can make informed decisions about which credit card is the right fit for you.

Secondly, it’s essential to develop healthy spending habits when using credit cards. It can be tempting to see credit as "free money," but it’s important to remember that each purchase represents a future repayment. Be mindful of your spending and only use credit cards for necessary expenses that align with your budget. Avoid overspending and strive to pay off your balance in full each month to avoid accumulating interest.

Lastly, staying organized and keeping track of your credit card activity is vital. Regularly review your statements to ensure there are no errors or fraudulent charges. Monitoring your credit card usage can also help you identify areas where you may be overspending or need to adjust your budget. Consider utilizing online banking tools or mobile apps to easily track your expenses and stay on top of your financial health.

By navigating credit cards with knowledge and careful consideration, you can harness their benefits while avoiding potential pitfalls. Remember to be proactive, stay informed, and approach credit cards as a tool for financial empowerment rather than a source of stress.

The Role of legalnewcreditfile

Legalnewcreditfile is a reputable company that specializes in providing assistance with Credit Cards & Auto Loans. With their vast experience and expert knowledge in the field, they have become a trusted resource for individuals seeking guidance and support in managing their financial needs.

One of the key roles of legalnewcreditfile is to offer valuable insights and information about credit cards and auto loans. They understand that these financial products can often be confusing and overwhelming for many individuals, and they aim to demystify the process. Through their comprehensive guide, they aim to break down complex concepts and terminology into easily understandable terms, empowering individuals to make informed decisions.

Furthermore, legalnewcreditfile provides personalized assistance to their clients. They understand that each individual’s financial situation is unique and requires careful consideration. By offering one-on-one support, they are able to tailor their guidance to specific needs, ensuring that clients receive the most relevant advice for their circumstances.

In summary, legalnewcreditfile plays a crucial role in helping individuals navigate the world of credit cards and auto loans. Through their informative resources and personalized assistance, they aim to empower individuals to make confident financial decisions, driving them towards financial freedom.

Archives

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | 31 | |