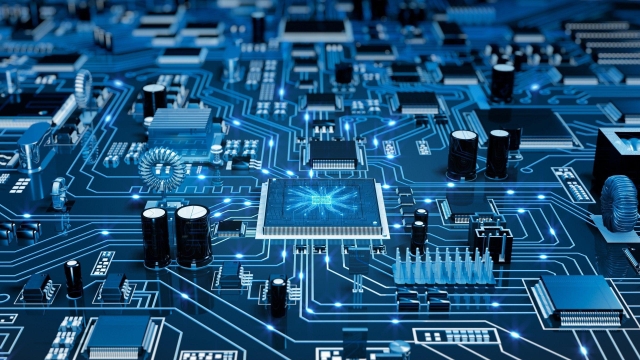

As technology continues to evolve at an exponential rate, the world of electronics stands at the forefront of these electrifying innovations. From the early days of basic calculators to the present era of smartphones and smart homes, electronic devices have become an integral part of our daily lives. These advancements have not only transformed the

Rebuilding Lives: The Power of Rehabilitation Have you ever marveled at the incredible resilience of the human spirit? Life’s unexpected turns can throw us off balance, leaving us physically or mentally wounded. But with the power of rehabilitation, we witness the indomitable strength of individuals as they rise above their circumstances and reclaim their lives.

Rehabilitation is a transformative journey towards a fresh start, embodying hope, resilience, and renewal. It is a path that holds the power to rebuild lives and restore independence. In this article, we delve into the important concept of rehabilitation and explore how it plays a crucial role in promoting healing, recovery, and well-being. At the

Rehabilitation paves the way for individuals to regain control of their lives, overcoming physical, cognitive, or emotional barriers that may have hindered their progress. It is a process of renewal, offering hope and a chance for an improved quality of life. In Germany, ‘Kliniken Schmieder’ stands as a prominent group of rehabilitation hospitals, recognized for

AI avatars have become a fascinating aspect of the ever-evolving field of Artificial Intelligence. These intelligent virtual beings have the ability to not only interact with users but also replicate human-like behavior and emotions. With advancements in technology, AI avatars are breaking new ground by seamlessly merging the digital and real worlds. Gone are the

Artificial Intelligence (AI) has made remarkable advancements in recent years, and one of the most intriguing applications of this cutting-edge technology is AI avatars. These virtual beings, powered by sophisticated algorithms, are revolutionizing the digital world by bringing a human touch to our online experiences. AI avatars, also referred to as Avatar AI, have the

Mental health care has long been shrouded in stigma and misunderstanding, but the tides are finally turning. In recent years, there has been a collective push to challenge the prevailing stereotypes and transform the way we address mental health issues. Breaking away from the erroneous notion of mental health as a weakness or something to

Windows play a crucial role in letting in natural light, offering stunning views, and enhancing the overall aesthetics of any space. However, over time, they can accumulate dirt, streaks, and grime, obstructing the clarity of the glass. This is where window cleaning becomes essential. By mastering the art of window cleaning, you can maintain radiant,

Having crystal-clear windows can make a world of difference in the overall appearance of your home. Letting in natural light and providing a clear view of the outside world, sparkling windows can truly enhance the ambiance within your living space. Window cleaning might seem like a daunting task, but with the right techniques and a

Running a small business can be an exhilarating experience, filled with opportunities for growth and success. However, with great ambitions come great responsibilities, and it is crucial for small business owners to protect themselves and their ventures against potential risks. One key aspect of safeguarding your business is investing in the right insurance coverage. While